Energy Transfer to acquire Lotus Midstream in a $1.45 billion transaction

DALLAS & HOUSTON--(BUSINESS WIRE)--Mar. 27, 2023--

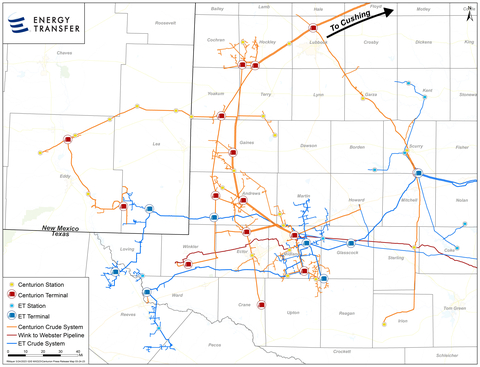

Energy Transfer LP (NYSE: ET) and Lotus Midstream LLC announced today that the parties have entered into a definitive agreement pursuant to which Energy Transfer will acquire Lotus Midstream Operations, LLC (Lotus Midstream) in a transaction valued at approximately $1.45 billion from an affiliate of EnCap Flatrock Midstream (EFM). Consideration for the transaction will be comprised of $900 million in cash and approximately 44.5 million newly issued Energy Transfer common units. Lotus Midstream owns and operates Centurion Pipeline Company LLC, an integrated, crude midstream platform located in the Permian Basin. The transaction is expected to close in the second quarter of 2023, subject to regulatory approval and customary closing conditions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230327005340/en/

(Graphic: Business Wire)

Complementary Crude Gathering, Transportation and Storage Assets

Lotus Midstream’s Centurion Pipeline Company provides a full suite of midstream services including wellhead gathering, intra-basin transportation, terminalling and long-haul transportation services. Its expansive system, encompassing approximately 3,000 active miles of pipeline, covers major production areas of the Permian with nearly 1.5 million barrels per day of capacity. Lotus Midstream’s Midland Terminal offers 2 million barrels of crude oil storage capacity and additional supply and demand connectivity. The acquisition also includes a 5% equity interest in the Wink to Webster Pipeline, a 650-mile pipeline system transporting more than one million barrels per day of crude oil and condensate from the Permian Basin to the Gulf Coast.

Energy Transfer’s acquisition of Lotus Midstream’s Centurion Pipeline assets will increase the Partnership’s footprint in the Permian Basin and provide increased connectivity for its crude oil transportation and storage businesses. The Centurion assets, located across some of the most active areas of the Permian Basin, provide significant gathering volumes from key producers while also enhancing Energy Transfer’s access to key downstream markets with consistent sources of demand. The assets provide direct access to major hubs including Cushing, Midland, Colorado City, Wink and Crane. The system is anchored by large cap producer customers with firm, long-term contracts, and significant acreage dedications.

Additionally, upon closing Energy Transfer expects to begin construction on a 30-mile pipeline project that will allow Energy Transfer and its customers the ability to originate barrels from its Midland terminals for ultimate delivery to Cushing. This project is expected to be completed in the first quarter of 2024.

Positive Financial Impact

The transaction is expected to be immediately accretive to free cash flow and distributable cash flow per unit as well as neutral to Energy Transfer’s leverage metrics. Lotus Midstream cash flows are supported by fee-based revenues from fixed-fee contracts.

Comments